TLDR

Crosschain interoperability connects isolated blockchain ecosystems, enabling seamless asset transfers, data sharing, and collaboration across chains. By reducing fragmentation, enhancing liquidity, and simplifying user experiences, it unlocks a unified, collaborative multichain environment. Technologies like atomic swaps, bridges, and Intents drive this transformation. Across Protocol’s Intents-based solution provides secure, fast, and user-friendly crosschain interoperability. Standards like ERC-7683 make Intents-based interoperability scalable, secure, and accessible for developers and users alike. As the blockchain landscape evolves, crosschain interoperability has become the cornerstone that unites networks, driving a truly interconnected onchain world.

Introduction to Crosschain Interoperability

The world doesn’t need more blockchains—we already have over 1,000 (and counting!). What we need is a way to connect them. Enter crosschain interoperability: the secret sauce to a truly unified blockchain ecosystem.

Crosschain interoperability allows independent blockchains to interact, exchange assets, and share data. It ensures a unified ecosystem where applications, developers, and users can thrive across chains. In this guide, we’ll explore the foundational concepts of crosschain interoperability, its benefits, core mechanisms, security concerns, and how it is transforming the blockchain landscape as we speak. Let’s dive in.

What is Crosschain Interoperability in Blockchain?

Crosschain interoperability is the ability for separate blockchain networks to seamlessly communicate, exchange assets, and share data. It transforms blockchains from isolated ecosystems into a connected, collaborative multichain environment.

Imagine the blockchain landscape as a sprawling city, where each chain represents its own vibrant neighborhood. Each neighborhood thrives with its own unique attractions, opportunities, and residents; however, they remain isolated from each other, preventing efficient collaboration and limiting the city’s potential as a whole. In this city, crosschain interoperability acts as the infrastructure—the bridges, roads, and high-speed transit systems. It transforms the city from a group of isolated neighborhoods into a thriving, unified metropolis.

With crosschain interoperability, separate blockchain networks can communicate with each other and seamlessly exchange assets and data. Historically, blockchains have operated in isolated ecosystems, creating siloed environments for applications, developers, and users. Interoperability breaks down these barriers, allowing assets and information to move freely across networks to unlock a connected, multichain environment.

Crosschain interoperability connects blockchain ecosystems.

Why Does Crosschain Interoperability Matter?

Crosschain interoperability isn’t just a convenience feature—it’s a necessity for the evolving blockchain landscape.

With the rise of L2s, L3s, rollups, and appchains, the number of deployed chains will only continue to grow. Interoperability connects these networks, empowering dApps across DeFi, gaming, and RWAs to easily tap into the unique features of each chain. This unlocks a seamless, multichain experience where users and developers can make the most of what every network has to offer. It is the key to driving a more interconnected and versatile blockchain space.

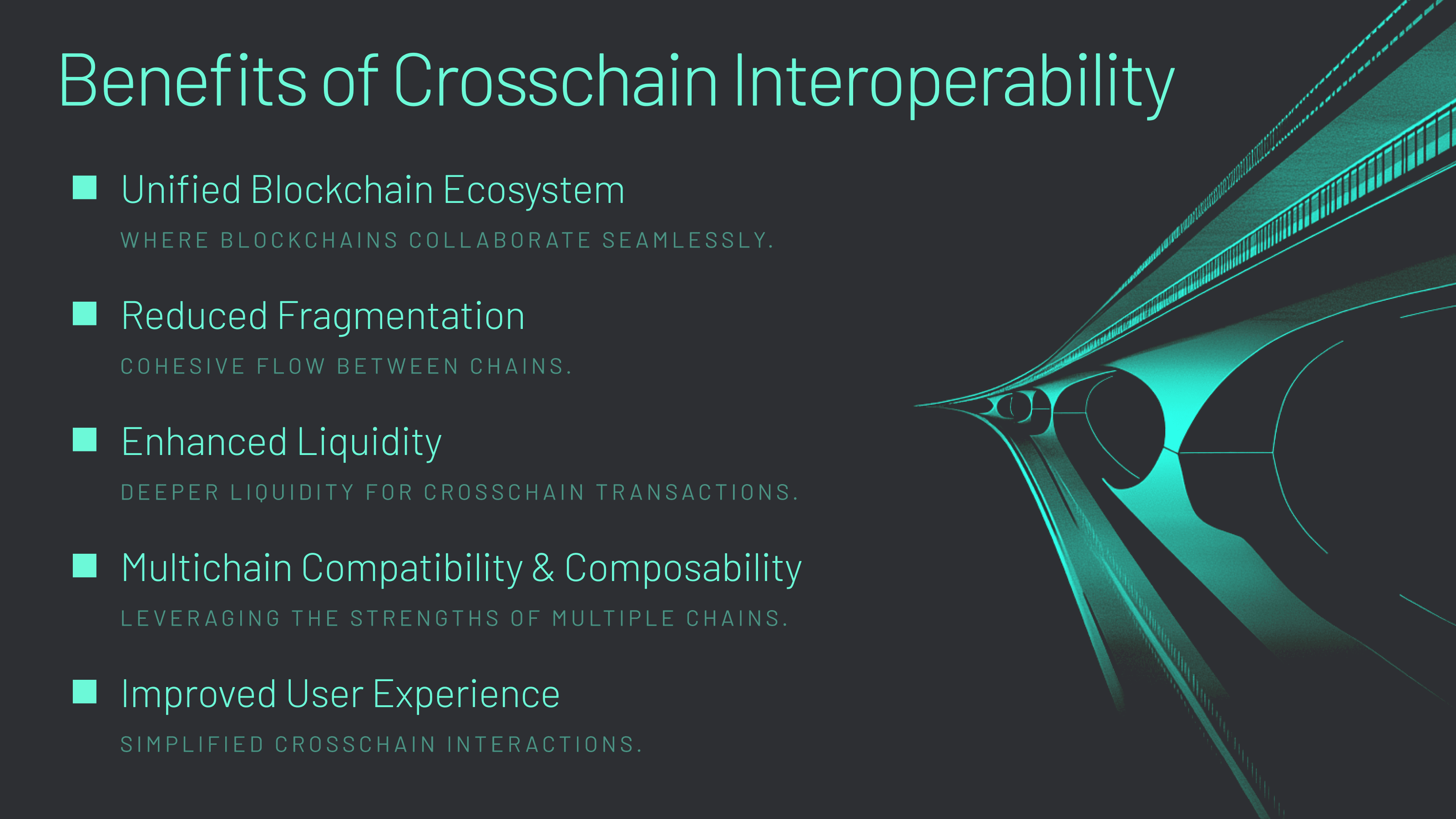

Unified Blockchain Ecosystem

With crosschain interoperability, we can build a seamless blockchain playground where users, apps, assets, and smart contracts move freely across networks without friction. This is what crosschain interoperability is all about. It empowers us to unlock the ultimate level of onchain connectivity and collaboration—the foundation for building a truly unified Web3 landscape.

Reduced Fragmentation

Crosschain solutions don’t just bridge the gaps between chains—they erase them. By consolidating siloed ecosystems into one unified environment, we can bring assets and liquidity together like never before. Imagine supercharging a DeFi protocol’s liquidity pools with multichain deposits, or expanding an NFT marketplace’s reach with crosschain minting. This isn’t just a technical upgrade; it’s a reimagination of how decentralized ecosystems work together. By unifying fragmented ecosystems, interoperability brings about a stronger, more integrated multichain environment.

No more barriers, no more fragmentation.

Enhanced Liquidity

Liquidity is the lifeblood of any blockchain ecosystem; However, it is often fragmented across isolated networks, leaving capital locked up and underutilized. Crosschain interoperability flips the script by breaking down barriers between chains, allowing assets to flow between them freely and efficiently. Imagine a DeFi protocol tapping into liquidity pools across Ethereum mainnet and every EVM L2 chain without requiring wrapped tokens or clunky bridges.

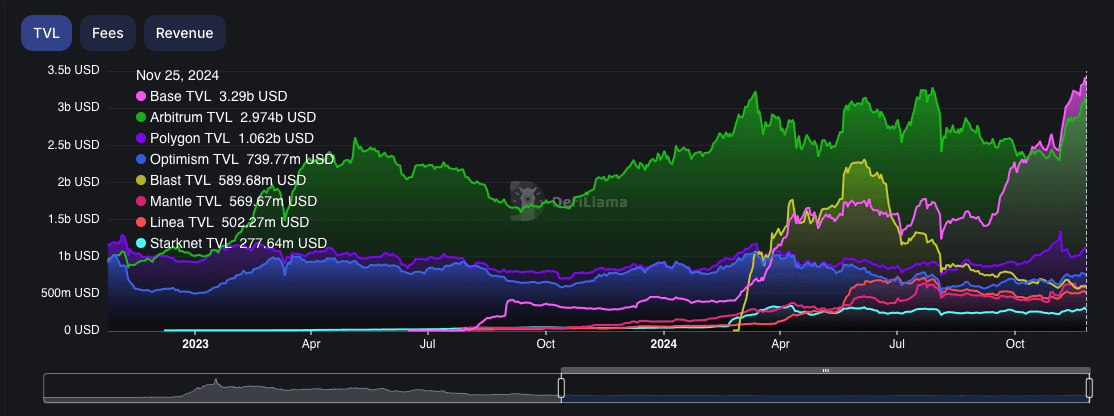

Let’s look at the numbers to better understand the current state of onchain liquidity. As of November 2024, the TVL across all DeFi is around $118 billion—$67.52 billion of it lives on Ethereum Mainnet. L2s like Base, Arbitrum, and Polygon hold $3.29 billion, $2.97 billion, and $1.06 billion TVL respectively. Other L2s like Optimism, Blast, Mantle, Linea, and Starknet each hold between $277.64 and $739.77 million TVL. Without crosschain interoperability, these massive pools of liquidity remain isolated from each other, severely limiting DeFi's full potential. Connectivity here is vital.

Connectivity doesn’t just increase trading opportunities—it amplifies capital efficiency, enabling deeper liquidity for lending, staking, and trading. Deeper and more diverse liquidity enables users to find better rates and more opportunities. The result? A more vibrant, interconnected multichain ecosystem where your assets can go further, faster. A brand new era for DeFi is here.

The eight most popular Ethereum L2 chains hold about $10 billion in cumulative TVL, but it’s fragmented.

Empowering DApps with Multichain Compatibility and Composability

Today’s dApps need to embrace the multichain future or risk being left behind. Crosschain interoperability enables applications to plug into the best features of every chain, expanding the possibilities for DeFi, NFTs, gaming, and other onchain industries in ways we’ve never seen before.

Multichain compatibility ensures that dApps can interact with multiple blockchain networks, leveraging each chain’s unique advantages to build more powerful and flexible solutions. Imagine if a DEX could combine the high throughput and low gas fees on Arbitrum with access to the extensive ecosystem on Polygon. Or if a lending dApp could blend zkSync’s account abstraction features with Optimism’s optimistic rollup environment.

Beyond compatibility, multichain composability takes things to the next level. It’s not just about accessing features on different chains—it’s about creating dApps that interact seamlessly across them, like building blocks that snap together no matter where they’re hosted. Picture a single smart contract that can orchestrate crosschain liquidity pools, stake assets in one network, and swap tokens on another—all in one transaction.

When you introduce crosschain compatibility and composability to the equation, the possibilities for dynamic dApps are truly endless. This is how we empower developers to create more innovative, creative, and overall cooler applications.

Improving User Experience with Crosschain Interoperability

Traditional Web3 UX sucks. If you’re a crypto native, you probably know just how tedious and frustrating it can be to interact or move funds across chains. Luckily, crosschain interoperability completely eliminates the hassles of onchain user experiences.

Smoother transfers? Check. Lower fees? Check. Seamless crosschain actions? Double check. It’s all about making the experience as frictionless as possible.

The best way to do this is to meet users where they are: at the application level. By abstracting away the hassle of crosschain interactions, dApps can become more intuitive for end-users. Simple actions, like swapping tokens, depositing assets into yield-bearing DeFi protocols, or purchasing NFTs, can be done directly across chains with minimal effort.

Crosschain wallet management systems allow users to manage assets across various networks with greater ease. No more switching between different wallets and networks. When applied effectively, users shouldn’t have to know what chain they are on to accomplish their goals.

If we want to drive and support mass adoption in this space, we must build better dApps that prioritize user experience and make new users want to stay onchain. Crosschain interoperability is the key for builders to create applications with enriching user experiences. By reducing costs, enhancing liquidity, and simplifying interactions, improved user experiences help position Web3 as a more practical and accessible option for broader audiences.

With this being said, how exactly do we enable crosschain interoperability?

Crosschain interoperability brings many benefits to users, developers, and dApps.

Crosschain Interoperability Mechanisms and Solutions

It’s time to explore the primary technologies that enable crosschain interoperability. Each one offers unique methods to facilitate secure and efficient crosschain communication, asset transfers, and complex interactions across blockchain networks. Let’s unpack each of them.

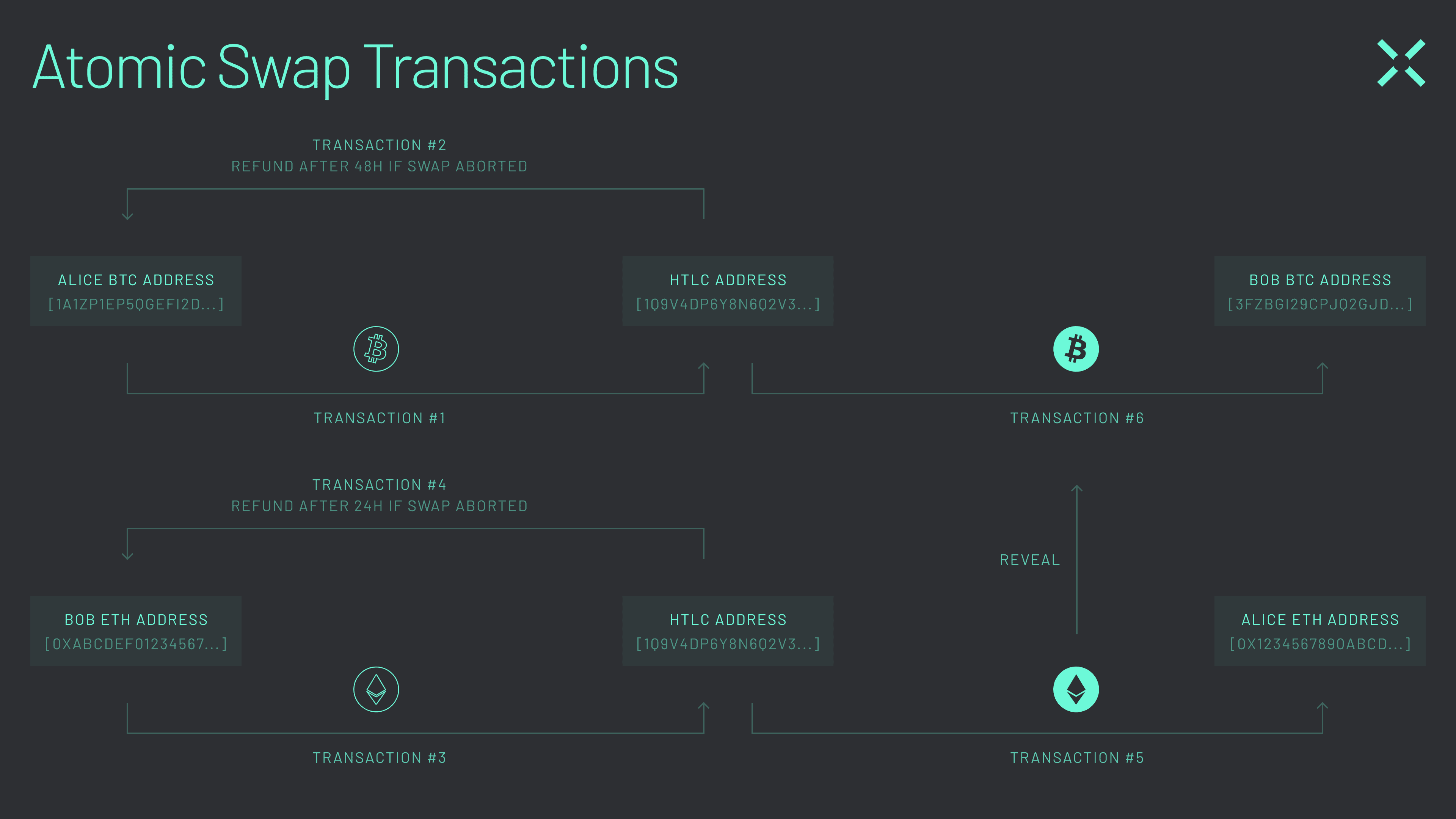

Atomic Swaps

Think of atomic swaps as the handshake of blockchain: no intermediaries, no fuss. Users can directly exchange digital assets across chains in a pure P2P manner. With fancy tech like hash-time locked contracts (HTLCs), it’s either a deal or no deal—but always secure.

Utilizing HTLCs, atomic swaps ensure that both parties receive their assets or the transaction is canceled, creating a secure, trustless environment. Thorchain and Komodo are examples of platforms that use atomic swaps to enable decentralized, peer-to-peer crosschain trading. Atomic swaps are an effective way to transfer assets without relying on centralized exchanges, reducing fees and increasing security.

Atomic swaps enable secure P2P swapping of assets across blockchain networks.

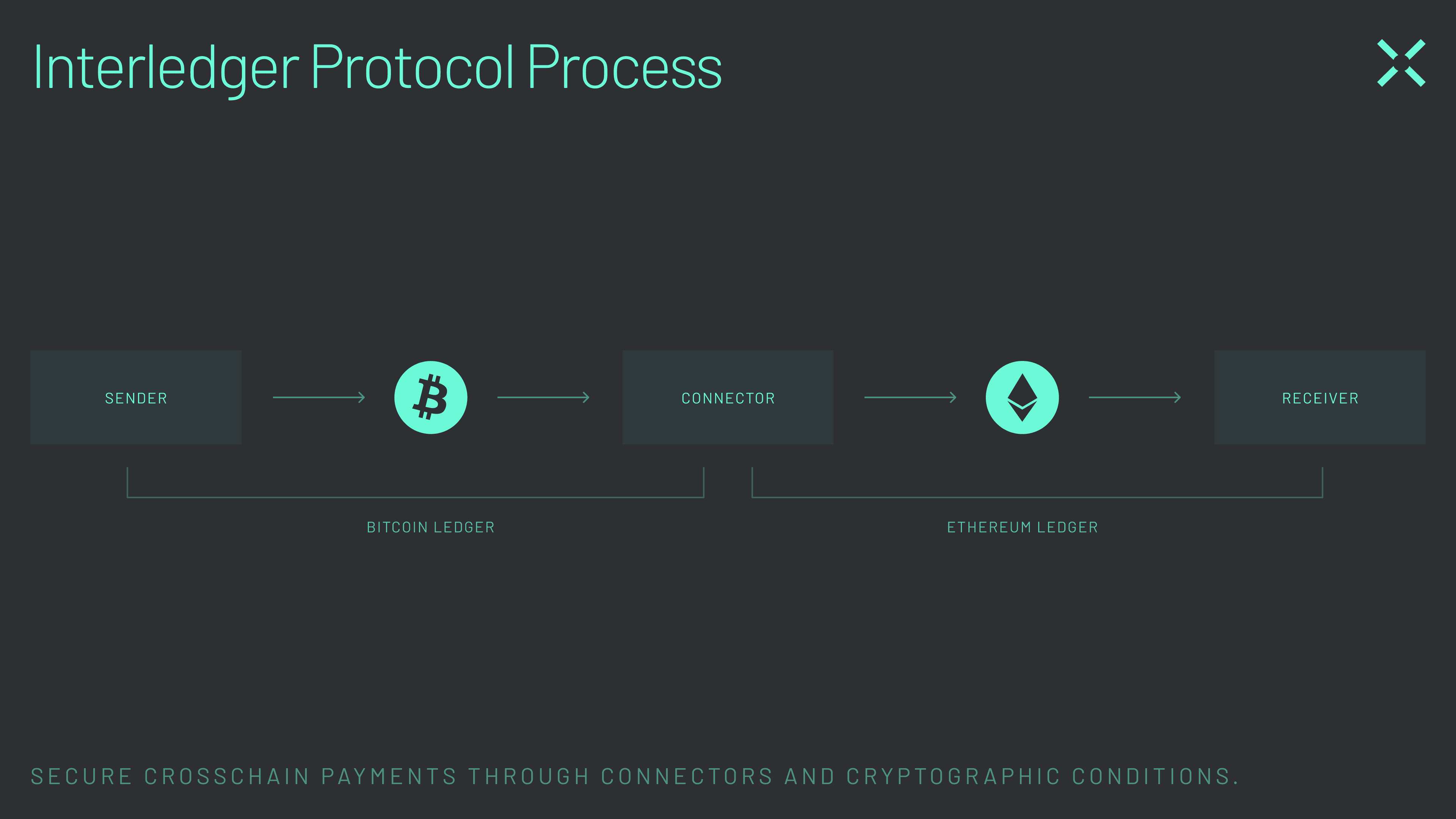

Interledger Protocols

Interledger protocols (ILPs) are like blockchain’s version of air traffic control—securely routing transactions between networks, even when those networks operate differently. Instead of forcing blockchains to “speak the same language,” ILPs rely on connectors to handle the heavy lifting. These connectors break transactions into smaller units, validate each step, and securely relay payments across chains. Think of it as a trustless relay race: the transaction only completes when every step along the route is validated, ensuring funds are transferred safely and efficiently.

Protocols like Interledger and Everclear use this technology to simplify crosschain payments and bridge gaps between financial systems. For example, ILPs make it possible for a payment to start on one blockchain, hop through multiple connectors, and settle on a completely different blockchain—all without compromising security or speed. This process enhances liquidity, reduces complexity, and helps blockchains work together, making crosschain payments smoother and more reliable than ever.

Interledger protocols secure crosschain payments through connectors and cryptographic conditions.

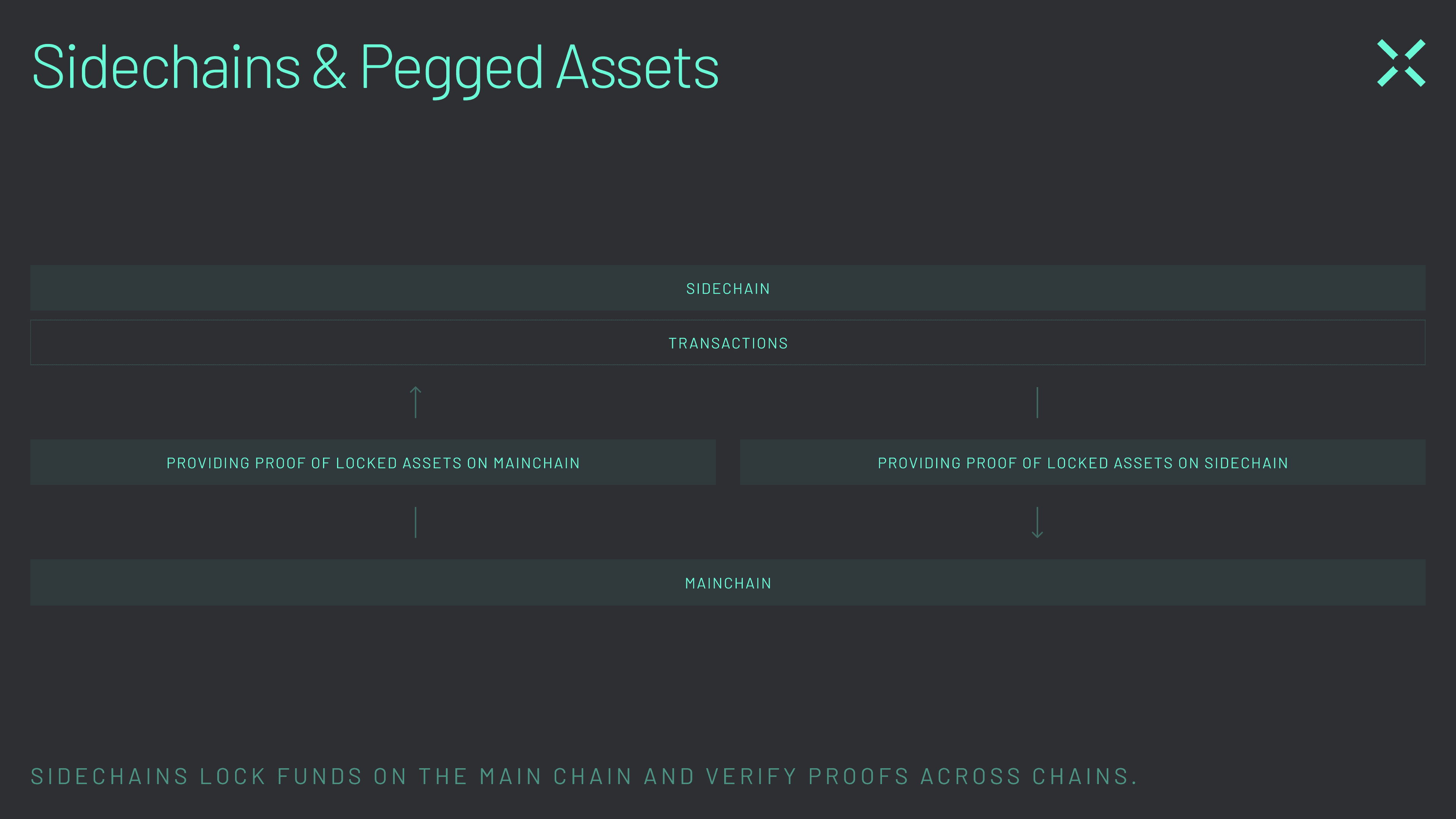

Sidechains and Pegged Assets

Sidechains are like the side roads that you can take when there is too much traffic on the blockchain highway. They operate as secondary chains running parallel to main blockchains, designed to offload transactions and increase scalability.

Pegged assets—tokens that represent assets on the main chain—facilitate transfers between the main chain and side chain, retaining value across networks. Polygon and Rootstock (RSK) are prominent examples, reducing congestion on primary chains and enabling faster transactions while maintaining interoperability.

Sidechains lock funds on the main chain and verify proofs across chains.

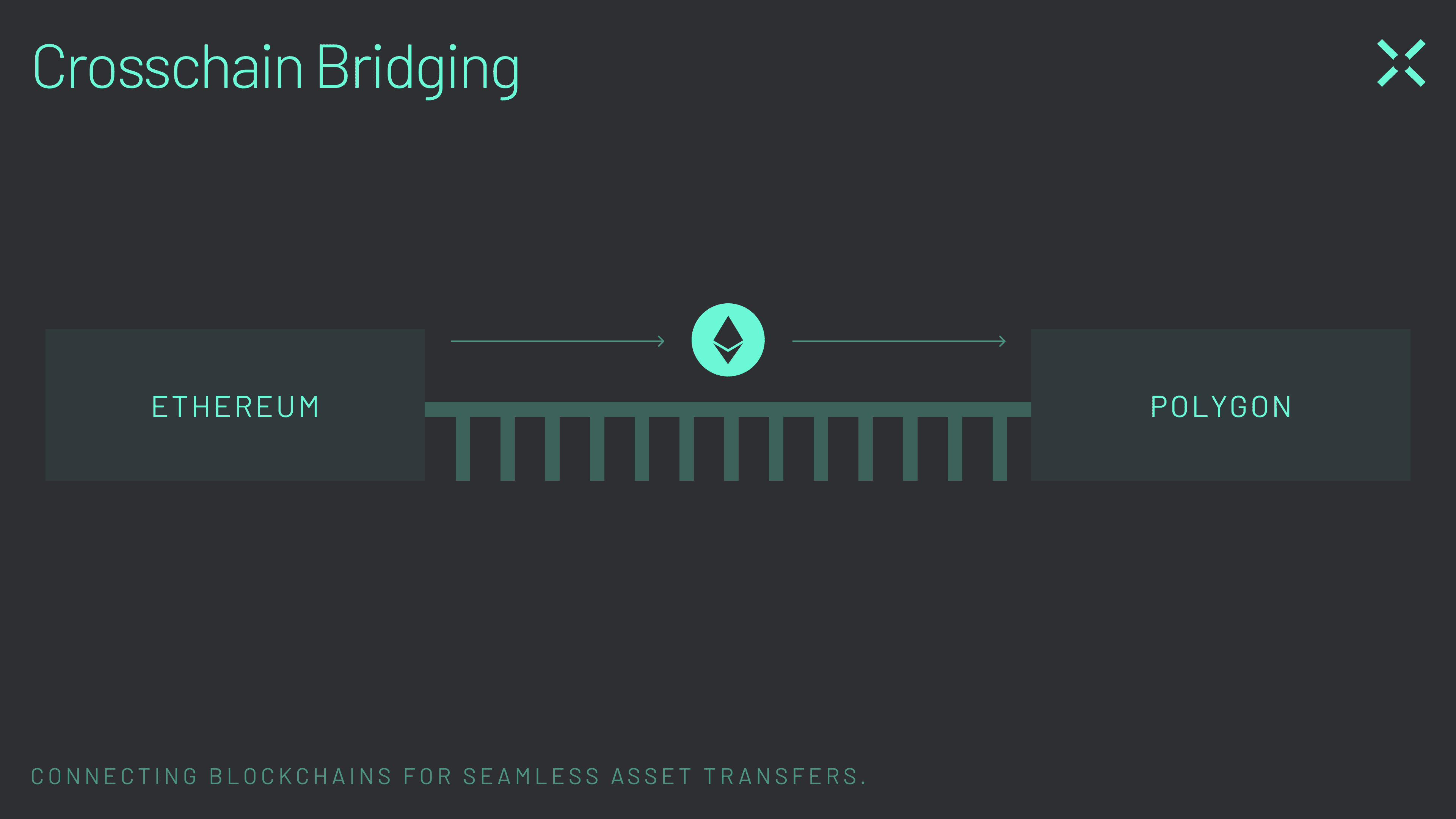

Crosschain Bridges

Crosschain bridges are self-explanatory—they allow you to “bridge” your assets across blockchains. Bridges play a central role in interoperability, allowing for the transfer of tokens and data between networks. They enhance liquidity and enable crosschain interactions while offering different security models tailored to varying network needs. Let’s take a closer look at the various bridge mechanisms used today:

Intents-Based Bridging: Across Protocol leverages a crosschain Intents framework to power Ethereum’s fastest bridge while maintaining low fees and security.

Lock-and-Mint / Burn-and-Mint: Tokens are locked on the source chain, and an equivalent amount is minted on the destination chain. This method is used by bridges like Wormhole, which connects Ethereum, Solana, and other chains.

Validator-Based Bridges: Decentralized validators confirm transactions across chains, enhancing security without requiring centralized authorities. Cosmos IBC is a prime example.

Oracle-Based Crosschain Messaging: Decentralized oracles relay transaction data securely across chains, allowing reliable transaction verification from trusted sources. Chainlink CCIP is a major example.

Ultra-Light Messaging: Protocols like LayerZero communicate directly with decentralized oracles and relayers, offering efficient data transmission without full node requirements.

Crosschain bridges connect blockchains for seamless asset transfers.

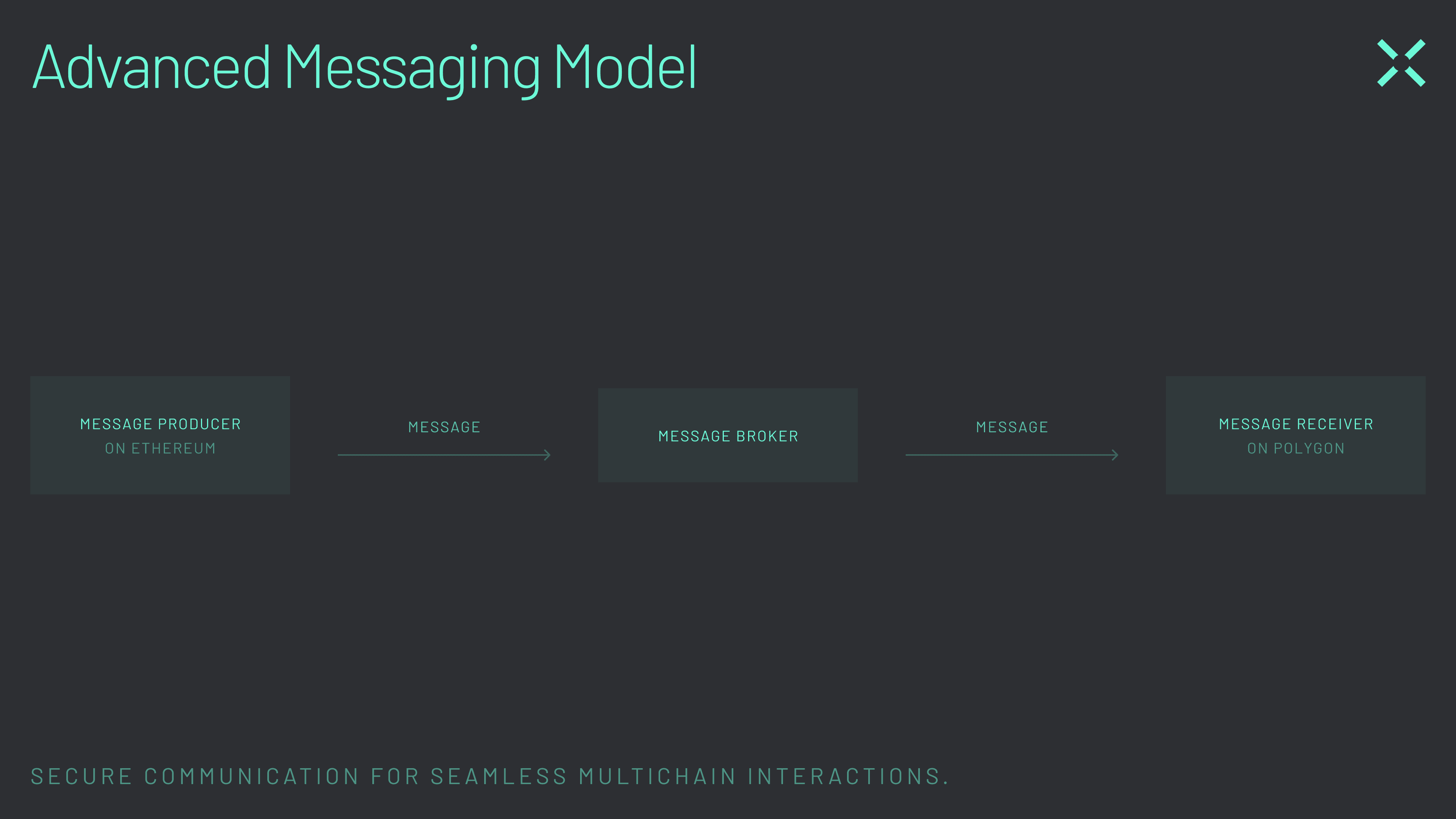

Advanced Messaging Protocols

Advanced messaging protocols are like telecom systems for crosschain communication—they make it possible for data to move securely between networks without actually transferring assets. These protocols validate and route specific instructions across chains, acting as a bridge for dApps to execute complex actions.

Take Axelar and Hyperlane, for example. They rely on validators and relayers to ensure message integrity, enabling multichain swaps, lending, and other intricate DeFi operations.

Advanced messaging models provide secure communication for seamless multichain interactions.

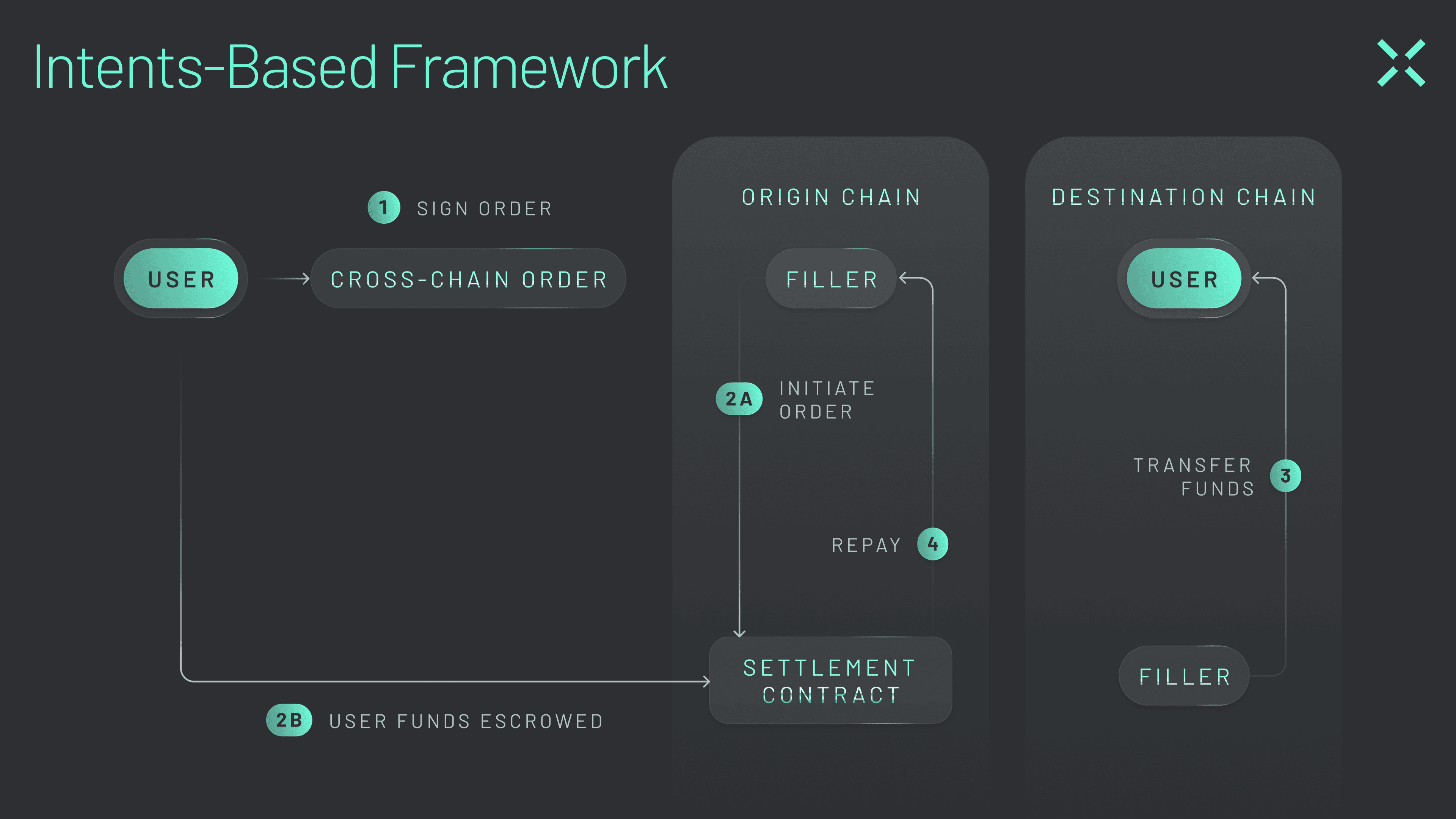

Intents-Based Crosschain Interoperability

Intents-based interoperability is rewriting the rulebook for crosschain actions. They empower users to specify high-level commands, or “Intents,” that declare what they want to achieve. Whether it’s transferring assets, staking tokens, or performing other crosschain activities, Intents make crosschain interactions intuitive, efficient, and secure.

Across Protocol takes Intents to the next level. It promotes maximum efficiency by leveraging a powerful, permissionless network of third-party fillers that compete to fulfill user Intents in the fastest, most cost-effective, and secure way possible. By abstracting away the complexity and removing all risk from users, Across’ approach delivers unmatched speed, affordability, and peace of mind, making crosschain interactions as effortless as they should be. Intents aren’t just an upgrade—they’re the future.

Intents abstract away the complexities of crosschain actions from the user’s experience.

The Role of Security in Crosschain Interoperability

Security is a major concern in crosschain interoperability. Why? Because connecting multiple chains introduces new vulnerabilities. Crosschain protocols must adopt a security-first approach, utilizing layered security models, decentralized validators, and monitoring mechanisms to protect assets during transfers. For example, Chainlink CCIP employs a Risk Management Network that monitors transactions for anomalies, adding an additional layer of protection.

Decentralized validators, like those used by Cosmos IBC, distribute trust across multiple entities, mitigating the risks of centralized control. Additionally, protocols like Across leverage third-party filler networks to execute crosschain Intents, reducing user exposure to potential threats. These security measures ensure your assets move across networks safely.

By establishing a secure foundation for crosschain interoperability, we can build a better future for the entire blockchain ecosystem. But what exactly does this future look like?

The Future of Crosschain Interoperability

Looking ahead, the future of crosschain interoperability is exciting. The landscape will be shaped by advancements in decentralized security models, emerging standards, and growing adoption. New approaches like restaking and validator pooling, pioneered by platforms such as EigenLayer, offer stronger security by aligning economic incentives and reducing validator fragmentation. These models bring increased trust and resilience to crosschain transactions.

Let’s take things a step further. Can the benefits extend beyond just the blockchain level? The answer is yes. Crosschain interoperability paves the way for integrating real-world assets onchain. As more tangible assets become tokenized, it becomes crucial for people to access and trade them across chains without barriers or friction. Although this is a bit forward-thinking, it’s a matter of “when,” not “if.”

So, how do we ensure that crosschain interoperability enables Web3 applications to better meet both onchain and real-world needs? By building standardized frameworks that anyone can use.

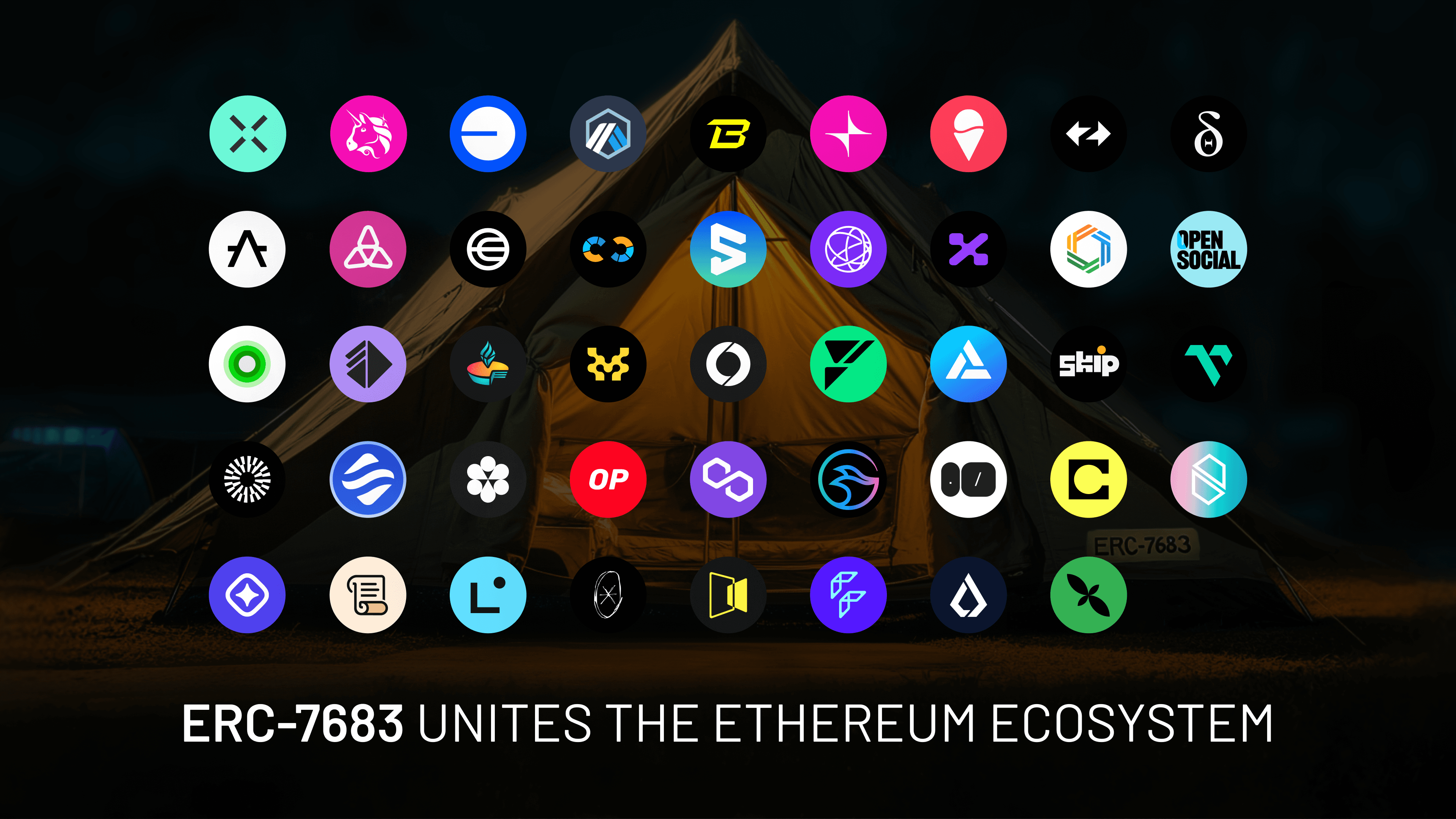

ERC-7683: Ethereum’s Standard for Crosschain Interoperability

Luckily, the standard we’ve all been waiting for is here. Co-developed by Across Protocol and Uniswap Labs, ERC-7683 introduces a universal, standardized framework for crosschain Intents across the EVM ecosystem. It supports seamless interoperability between Ethereum mainnet, L2 chains, rollups, appchains, and sidechains in an accessible, scalable, and secure manner. ERC-7683 addresses the need for consistent, crosschain functionality, making it simpler for developers to build and for users to interact across these networks.

In simple terms, ERC-7683 unifies Ethereum’s ecosystem and reduces friction for crosschain activities. For users, it simplifies crosschain Intents—like token swaps, NFT transfers, and crosschain deposits—for all users. Developers can access a standardized API, which lowers integration costs and enables broader liquidity access.

Over 40 projects have pledged their support for ERC-7683. As the standard gains adoption, it will help builders create a unified, scalable Ethereum ecosystem, potentially influencing interoperability across other blockchains.

Over 40 projects have pledged their support for ERC-7683 to unify the Ethereum ecosystem.

Challenges in Achieving Full Crosschain Interoperability

Despite all its exciting potential, achieving full crosschain interoperability comes with challenges. Security risks remain a concern, as bridging protocols can expose funds to vulnerabilities. Scaling the infrastructure to handle crosschain transactions is another hurdle, particularly as user demand increases. Additionally, the lack of standardized governance and protocols across blockchains can hinder interoperability, highlighting the need for universal standards to ensure smooth, compliant interactions. Again, this is why standards like ERC-7683 are so important.

Closing Thoughts

Crosschain interoperability isn’t just nice to have—it’s the backbone of the next-gen blockchain landscape. From DeFi to dApps, it’s all about making the onchain world work smarter, not harder.

Across Protocol makes crosschain interoperability accessible through an Intents-based approach, simplifying the user experience and providing secure, scalable solutions. Retail Users can use Across Bridge for fast, cheap, and secure crosschain bridging. Developers can utilize Across’s SDK and API to bake seamless crosschain functionality straight into their dApp’s UI. Across does all the heavy lifting so you can enjoy crosschain interoperability without even knowing it’s happening.

As the blockchain landscape evolves, crosschain interoperability has become the cornerstone that unites networks, driving a truly interconnected onchain world—and we’re excited to be part of it.

FAQ: Understanding Crosschain Interoperability

1. What is crosschain interoperability in blockchain?

Crosschain interoperability is the capability that allows separate blockchain networks to communicate, share data, and transfer assets seamlessly. This enables decentralized applications and digital assets to operate across multiple blockchains, fostering connectivity within the ecosystem.

2. Why is crosschain interoperability important?

Interoperability reduces blockchain fragmentation and improves liquidity by enabling assets and applications to interact across chains. It supports multichain DeFi and dApps, expanding accessibility and scalability within the blockchain network.

3. How does crosschain interoperability work?

Interoperability mechanisms like atomic swaps, bridges, validator networks, and Intents enable assets and data to move securely between blockchains, facilitating verified crosschain interactions.

4. What are the benefits for retail users?

Crosschain interoperability also simplifies and enhances user experiences across different chains. Retail users benefit from crosschain interoperability through seamless asset transfers, reduced transaction fees, and access to larger liquidity pools for DeFi and trading.

5. What are the security risks of crosschain interoperability?

Security risks include potential vulnerabilities in bridge protocols and validator centralization. To mitigate these risks, protocols implement layered security, decentralized validation, and robust monitoring systems to ensure safe crosschain transactions.

6. What is the role of validators in crosschain interoperability?

Validators confirm crosschain transactions, distributing trust across multiple entities. Protocols like Cosmos IBC use decentralized validators to avoid single points of failure, creating a trustless environment.

7. How does Across enable crosschain interoperability?

Across Protocol uses an Intents-based approach, allowing users to specify high-level actions for crosschain operations and offload the complex execution processes and risk to third-party fillers. This simplifies crosschain interactions and enhances them with optimized speed, cost, and security.

8. Are sidechains the same as crosschain bridges?

No. Sidechains are independent chains connected to a main blockchain, while crosschain bridges directly connect two or more chains, enabling asset and data transfers across them.

9. What are some emerging solutions for crosschain security?

Restaking and validator pooling, used by platforms like EigenLayer, strengthen crosschain security by aligning incentives and reducing validator fragmentation. Additionally, Intents-based relayer networks remove risk from users by fulfilling their crosschain Intents and fronting their funds on the destination chain.

10. How can we implement crosschain interoperability at scale?

Universal standards, like ERC-7683, provide developers with common frameworks to build crosschain applications. It supports seamless interoperability between Ethereum mainnet, L2 chains, rollups, appchains, and sidechains in an accessible, scalable, and secure manner.